Avoid Commingling PPP Loan Funds to Maximize Forgiveness

By Leah Wietholter, MBA, CFE, PI

Currently, all the buzz around the Paycheck Protection Program is centered on who did or did not receive funds before the money ran out. In a few weeks, though, we will begin hearing about small business owners being challenged on whether their funds were used as intended. As a forensic accountant, the majority of my investigations require my team to identify how money was spent. With this expertise, I’ve developed the following recommendations and accompanying Excel worksheet for borrowers who want to ensure a smooth review with their banks to have their loan forgiven.

1. Deposit your PPP loan funds into a separate bank account.

The term of art in the forensic accounting world for bank accounts with funds deposited from multiple sources is “commingled”. To help your bank move through their approval process more quickly, hastening the forgiveness of your loan, do not commingle your revenue with the PPP loan funds. Requiring the bank to “un-commingle” your account increases the risk that your expenditures are not clearly understood, in turn, that the amount approved for forgiveness is less than it should be.

2. Use the funds from this separate bank account distinctly and only for approved purposes.

The PPP loan program specifies the approved and forgivable uses of the funds. When possible, pay expenditures directly from the separate bank account. Because this is likely a temporary bank account, it may be inconvenient to change your ACH instructions for the approved expenditures. If this is the case, only transfer the exact amount needed to cover each approved expenditure to your primary operating account from which the payments will be made.

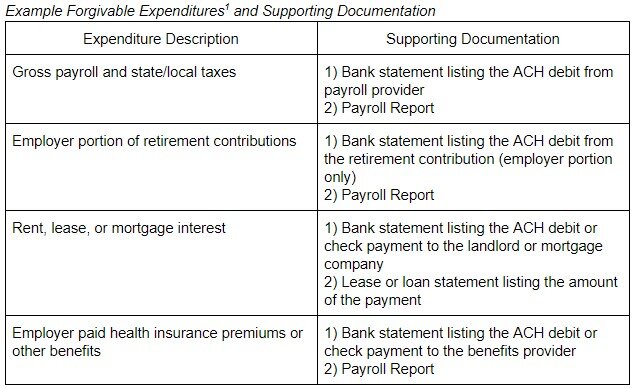

3. Create a list of all relevant transactions with supporting documentation.

Starting with the amount of loan funds you received, create a list of the approved expenditures paid from the loan funds. This list should match your separate bank account transactions exactly. For each transaction, include a supporting document that verifies the transaction description and amount. Examples of supporting documentation are listed in the table at the end of this article.

4. Track the uses of the funds to ensure payroll expenses are 75% or greater of the total loan amount.

Only 25% of the loan proceeds can be used for non-payroll expenses. As you track your expenditures, make sure your payroll expenditures are 75% or greater than the non-payroll expenditures.

Also remember, if you do not maintain your staffing and payroll levels, a portion of your loan may not be forgiven. For more information on these requirements, please review guidance from the Treasury.

5. Use our free template to help you manage your expenditures and maximize your loan forgiveness.

The downloadable template created by Workman Forensics will guide you through these steps so at the end of the eight weeks, you can present your bank with an organized list and supporting documents to help them understand how you followed the guidelines and should receive forgiveness for your PPP loan.

Free template link: www.workmanforensics.com/wf-products/ppp-funds-worksheet

Don’t have time or feel like this is outside of your expertise? Give us a call. We’re happy to prepare all of this for you.

Contact: Megan Brown, CPA, PI, Forensic Accounting Manager

services@workmanforensics.com

1 For a complete list of forgivable expenditures and requirements, please review guidance from the Treasury and Small Business Administration.